Trump Insiders Grift $20 Billion As President-elect Launches $Trump

Trump Launches $TRUMP Memecoin: A Financial Power Play or a National Embarrassment?

Three days before his second inauguration, Donald Trump stunned the world by unveiling a new cryptocurrency called $TRUMP. Valued at an astonishing $20 billion in market cap within days, the memecoin has sparked outrage, admiration, and deep concern across political and financial circles. While Trump’s loyal base may view this as a bold and innovative move, critics argue that it’s a reckless and self-serving venture that puts personal gain above national interest.

The Questionable Allocation of $TRUMP

The official documentation for $TRUMP reveals a troubling allocation structure. According to GetTrumpMemes.com, 80% of the tokens are owned by two Trump-affiliated entities: CIC Digital LLC, an affiliate of The Trump Organization, and Fight Fight Fight LLC. These entities are subject to a three-year unlocking schedule, ensuring that Trump’s inner circle retains the lion’s share of the profits for years to come. Meanwhile, the public is left with just 10% of the total allocation, a stark imbalance that raises questions about fairness and decentralization.

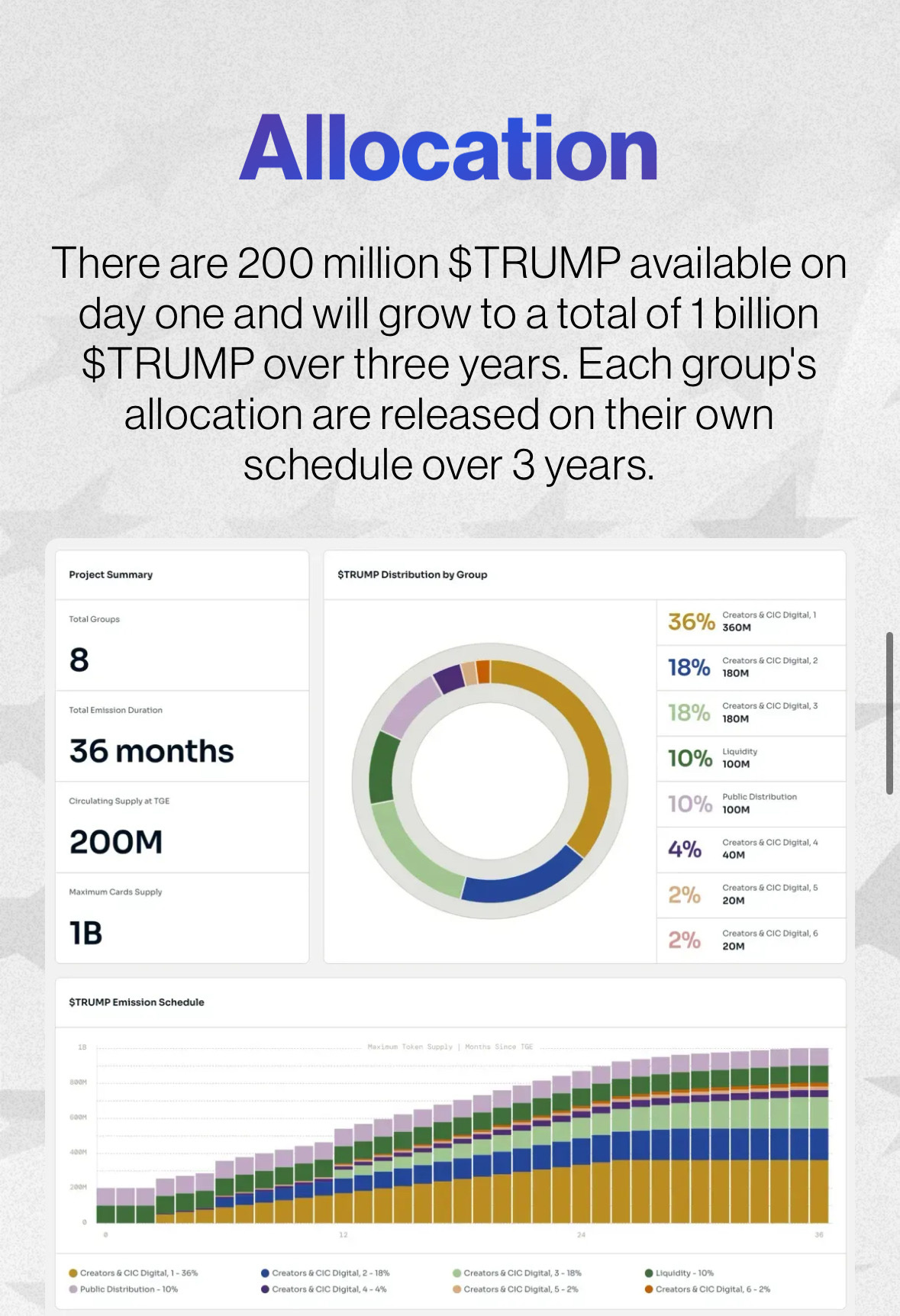

The breakdown of the $TRUMP token supply is as follows:

• 36% (360M tokens) for Creators & CIC Digital 1

• 18% (180M tokens) for Creators & CIC Digital 2

• 18% (180M tokens) for Creators & CIC Digital 3

• 10% (100M tokens) for public distribution

• 10% (100M tokens) reserved for liquidity

• Smaller portions of 4%, 2%, and 2% for additional creator-controlled allocations

Currently, 200 million tokens are in circulation, with the total supply set to grow to 1 billion over three years. The project claims to embody “engagement with the ideals and beliefs” symbolized by $TRUMP while insisting it is not intended as an investment vehicle. However, with Trump and his affiliates controlling 80% of the tokens, the project appears to prioritize their financial gain over public engagement or decentralization.

Financial Irresponsibility and Ethical Concerns

Launching a memecoin days before assuming the presidency is unprecedented—and many argue—irresponsible. By tying his name to a cryptocurrency with a soaring market cap, Trump has effectively weaponized his political influence for personal and financial gain. The official website states that the project is not linked to any political campaign, yet its timing and branding suggest otherwise. The entities tied to $TRUMP are poised to generate significant revenue from trading activities, making this venture a windfall for Trump’s allies regardless of the token’s future market performance.

This move raises troubling ethical questions: Can a sitting president ethically oversee a financial venture that could so clearly enrich his inner circle? Critics argue that it blurs the lines between public service and personal enrichment, setting a dangerous precedent for future leaders.

Dividing the Crypto Community

The $TRUMP memecoin has sent shockwaves through the cryptocurrency community. While some see it as an exciting innovation, others—especially Bitcoin enthusiasts—view it as a mockery of the principles of decentralization and financial sovereignty. Bitcoin has spent years fighting to be recognized as a legitimate, decentralized asset. The sudden rise of $TRUMP, with its blatant centralization and political overtones, threatens to undermine the credibility of the entire crypto industry.

This development also risks turning cryptocurrency into yet another polarizing issue in American society. Trump supporters may rally behind $TRUMP as a symbol of loyalty, while skeptics decry it as a cynical cash grab. The memecoin could drive further distrust in the crypto market, especially among those who see it as a tool for political manipulation.

A Dangerous Precedent for the Presidency

Perhaps the most alarming aspect of $TRUMP’s launch is the precedent it sets. By creating a financial instrument tied so directly to his brand, Trump has blurred the lines between his political career and business ventures. This move could embolden future leaders to exploit their public office for personal profit, eroding trust in both government and financial markets.

Moreover, the project’s framing as “not political” rings hollow. The imagery, branding, and very name of the token suggest otherwise, tying Trump’s financial success to his political identity in ways that cannot be ignored.

Conclusion

The launch of $TRUMP days before Trump’s inauguration may be celebrated by his supporters, but it raises significant concerns about ethics, responsibility, and the future of cryptocurrency. With 80% of the token supply controlled by Trump’s inner circle, the project seems designed less to empower the public and more to enrich a select few. At the same time, its polarizing nature threatens to undermine the legitimacy of cryptocurrency as a whole.

As the $TRUMP memecoin continues to dominate headlines, one thing is clear: this is not just a financial story—it’s a test of how far a political figure can go in merging personal profit with public influence. Whether it’s remembered as a groundbreaking innovation or a cautionary tale remains to be seen. But for now, the $20 billion question is whether Trump has pushed the boundaries too far.