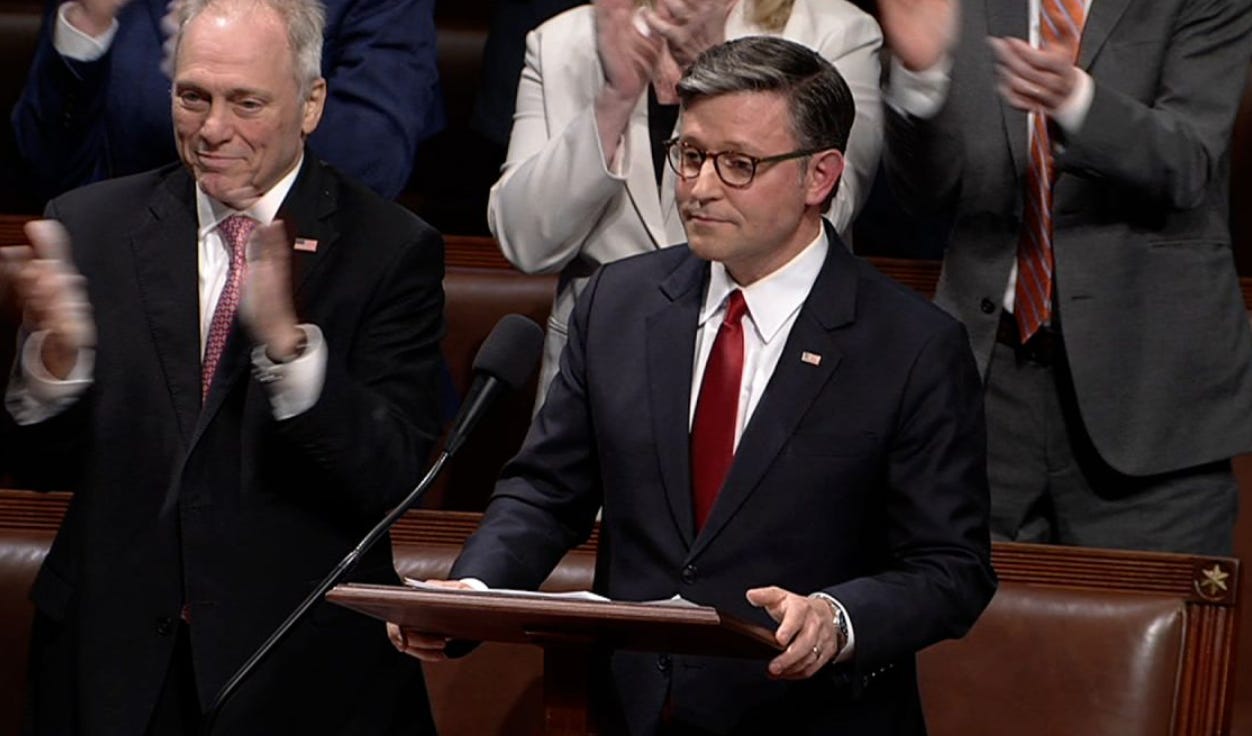

BREAKING The “Big UGLY Bill” passes

BREAKING “Big Beautiful Bill” passes and the spin coming from Republican leadership is thicker than summer humidity in D.C. But the numbers, and the fine print, tell a very different story. Below is the plain-language rundown, stripped of the talking-point glitter, so you can see exactly who wins, who loses, and why the bill’s title may be the only “beautiful” thing about it.

The Price Tag Nobody Wants to Say Out Loud

• Adds three-point-four trillion dollars to the deficit over the next decade, an ocean of red ink that our kids will be asked to mop up.

• Temporary program sunsets mask the long-term cost. Don’t be fooled; legislators are already hinting they’ll “fix” those sunsets later, driving the real price even higher.

Promises to Working Families? Vaporized.

• Paid family leave was advertised at twelve weeks. The final text? Zero.

• The child-tax-credit boost lasts just a handful of years, setting up a devastating poverty snap-back when it vanishes.

• Universal pre-K expires after six years, leaving states on the hook for billions or forcing rollbacks that will hit parents hardest.

• Free community college? Gone. Rural broadband expansion? Halved. Housing support? Slashed nearly fifty percent.

Health Care Shell Game

• Drug-price “negotiations” are limited to a tiny group of medicines—and only years down the road.

• There is no public option, no Medicare-for-All pilot, and no cap on insulin for privately insured Americans.

• Meanwhile, fossil-fuel subsidies stay intact and new drilling leases move forward, undermining any health-based climate gains.

Tax Policy—Tilted Like a Vegas Roulette Wheel

• Corporate minimum tax set at fifteen percent, lower than Ronald Reagan’s era.

• The wealth surtax doesn’t start until you hit eight-figure income territory, and capital-gains giveaways such as the stepped-up basis remain untouched.

• The headline promise to “finally tax Amazon and fifty-four other freeloaders” has been diluted into a modest alternative-minimum-tax tweak.

• Carried-interest loophole? Safe. Estate-tax threshold? Still an eye-popping twelve million dollars.

Labor, Wages, and Everyday Work

• Not a dime for a higher federal minimum wage, $7.25 remains the floor.

• Gig-worker protections, the PRO Act’s collective-bargaining muscles, and any crackdown on union-busting? All left on Mitch McConnell’s cutting-room floor.

• IRS enforcement trimmed back, ensuring the ultra-rich keep parking yachts in tax havens while working parents sweat an audit over a child-care credit.

Climate Commitments on Life Support

• Clean-energy action hinges almost entirely on fragile tax credits rather than enforceable standards.

• The Civilian Climate Corps, a marquee youth-jobs program, is erased.

• Electric-vehicle rebates shrink below what even moderate Republicans had teased, and the gargantuan carbon footprint of the Pentagon isn’t counted at all.

Democracy and Justice Left Out in the Cold

• No funds for voting-rights expansion, no D.C. statehood, and police qualified immunity is left untouched.

• Immigration “reform” shrinks to a commission study and limited parole extensions, far from the broad overhaul voters were promised.

The Bottom Line

Republicans have marketed this package as a once-in-a-generation victory for ordinary Americans. Read closely, though, and you find a deficit time-bomb, temporary social fixes that evaporate right when families start to rely on them, and a tax code that still bends the knee to dynastic wealth and corporate muscle. Call it the “Big Beautiful Bill” if you want, but after the fireworks fade, everyday Americans will be the ones left holding the bag.

If you believe democracy works best when voters know the unvarnished facts, share this breakdown with a friend today. The truth is only powerful when it’s passed along.

I'm sick. What will happen to our friends and families who really need health care assistance? I hope everybody realizes that nursing home care is usually paid by Medicaid--after all your assets are gone.

Fuck all nazi republicans.